QuickBooks for Law Firms: Complete Review, Features, Pricing

QuickBooks for Law Firms

Our Comprehensive Review | 2023

Introduction to Law Firm Accounting Software

Accounting is an essential function of any business, and law firms are no exception.

However, law firms have unique needs when it comes to accounting. Most law firms need:

- General / Business Accounting

- Trust / IOLTA Accounting

- Cash Basis (vs. Accrual)

- Multiple Billing Types (Hourly, Fixed Fee, Contingency)

- Law Firm-Centric Financial Reporting

- Financial Reporting by Matter

A common point of confusion are the different types of law firm accounting software. The term “law firm accounting” tends to be thrown around pretty liberally, and is often (inaccurately, in our view) used to describe billing and trust features, but lac the core/traditional accounting software fundamentals (like a Chart of Accounts, P&L, Balance Sheet).

In addition, there is general-purpose accounting software (that is: accounting software meant to be used by any type of business, but does not necessarily include the law-firm-specific functions that you may need.)

Juris is dedicated legal accounting. It provides sophisticated, end-to-end legal billing and all accounting functions that a law firm needs.

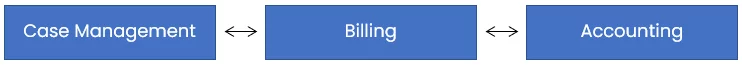

Accounting vs. Practice Management Software

Law Practice Management, Billing, and Accounting are three related, but discreet functions. And each can be managed with different software (or, all in one software suite). This is where the fuzzy terminology makes understanding what any given software package does confusing.

Broadly speaking, Law Practice Management software manages a firm’s clients, contacts, calendars, cases, time and expense tracking, billing and other “front-office” functionality.

Some Practice Management applications include complete accounting (including everything you see above), and some practice management applications provide time tracking, billing, and expense tracking… but leave the actual accounting to separate software (which it may integrate with).

Law Practice Management applications like Clio, Practice Panther and Time Matters do provide time tracking, billing and even reporting on billings… but they do not provide the “rest of accounting,” and instead integrate with applications like QuickBooks to complete the picture.

This is not to say one method is better than the other; rather it makes defining and understanding the classes of law firm accounting software important.

Related:

Sidebar: Legal Document Management

QuickBooks is a great accounting tool for many law firms. Many firms also need a secure and easy platform to store and manage documents (and email).

Your firm may need to supplement QuickBooks with a dedicated Document Management System to securely manage firm documents and email.

You might consider LexWorkplace, document management software born in the cloud, built for law firms.

- Securely Store & Manage Documents in the Cloud

- Client/Matter-Centric Document Organization

- Full-Text Search Across All Documents & Email

- Outlook Add-In: Save Emails to Matters

- Work with Windows and Mac OS

Introduction to QuickBooks for Law Firms

QuickBooks, by Intuit, is long-running and almost undeniably the most well-known small/midsize business accounting software.

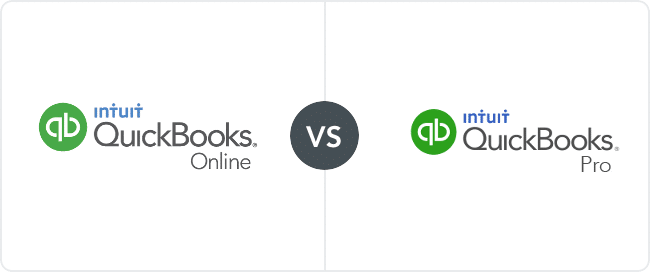

QuickBooks is industry-neutral accounting software, which means it can be (and is) used by many different industries, including law firms. QuickBooks has two product-lines, it’s Professional product, which runs as an installed application on your PC or within a Virtual Desktop (more on this shortly), and their Online product, which is the web-based version of the QuickBooks software.

QuickBooks Online

QuickBooks Online is the web-based version of QuickBooks. The advantages of QuickBooks Online are that it runs in your web browser, no software installation (or updates) required. The disadvantage is that QuickBooks online doesn’t provide as many features as its older, desktop counterpart (Professional).

Broadly speaking, QuickBooks Online is a good fit for law firms that:

- Are Solo or Very Small Practices

- Have Very Simple Accounting Needs

- Prefer Accounting in a Web Browser

QuickBooks Professional

QuickBooks Professional (sometimes also referred to as QuickBooks Desktop) is the traditional, desktop-installed version of QuickBooks. The advantages of QuickBooks are a more robust, more developed set of features.

Broadly speaking, QuickBooks Professional is a good fit for law firms that:

- Have 5 or More Employees

- You Need More Sophisticated Financial Management Tools

- Your Firm Has Years of Historical Data in QuickBooks Professional

Some of the more advanced functionality available in QuickBooks Professional, but not QuickBooks Online, include:

- Robust Budgeting / Budget vs. Actual

- Memorized Transactions

- Sophisticated Custom Reporting

- Loan Manager / Amortization Table Management

Another important consideration is your Practice Management solution. Yours may integrate with only Online, Professional, or both.

If your firm needs the sophistication of QuickBooks Professional but prefers to work in the cloud–fear not, we’ll explore the various cloud options for all editions of QuickBooks next.

The Company

QuickBooks is the flagship product of Intuit, Inc, the makers of QuickBooks, TurboTax, Mint personal finance software, and Lacerte and ProConnect tax software.

Using QuickBooks: Desktop, Hosted or Online

As described above, QuickBooks comes in one of two families: Professional (Desktop) or Online, with the former being more developed and robust.

There are effectively three ways you can use QuickBooks:

-

- QuickBooks Professional installed locally on your firm’s desktops/server (On-Premise).

- QuickBooks Professional run within a Private Cloud / Virtual Desktop (Cloud).

- QuickBooks Online (Cloud).

QuickBooks Professional Installed Locally

Your first option is to simply install QuickBooks on your law firm’s local desktops and server(s). This involves installing the QuickBooks server component on your firm’s on-premise server, setting up a shared folder to hold your QuickBooks company file, installing the QuickBooks software on the appropriate users’ desktops, and connecting the desktops to your server.

This is probably the least desirable option, as it requires managing and maintaining in-house IT infrastructure, and limits your team’s ability to work from anywhere.

QuickBooks Professional in a Private Cloud / Virtual Desktop

Your second option is to run QuickBooks professional (the desktop edition) in a hosted Private Cloud, or Virtual Desktop. (We use these terms interchangeably here.) This involves hiring a Cloud Service Provider to host QuickBooks professional (likely along with your other software, documents and data) in a completely hosted environment, and providing a Virtual Desktop for everyone if your firm to work in (from anywhere).

This is probably the most desirable option, as you get the robust feature-set of the Professional version of QuickBooks, and all the benefits of the Cloud (no servers to manage, increased data security, the ability to work from anywhere).

Related:

See below for more information on running QuickBooks in a private cloud for your law firm.

QuickBooks Online (Web-based)

Your third option is to simply use of the editions of QuickBooks Online, which is web-based and lightweight. This involves simply signing up for a QuickBooks Online account (pricing information is below), and creating logins for each person in your firm that needs it.

This option is probably best suited for solo and very small law firms (5 total people or less). If your law firm needs quick-and-dirty accounting, and doesn’t need the richer feature set and capabilities of QuickBooks Professional, QuickBooks online may be a great option.

See QuickBooks in Use

QuickBooks Professional and Online have similar fundamentals, but slightly different interfaces. QuickBooks Online arguably has a simpler, cleaner interface, while QuickBooks Professional has more in the way of features and capabilities.

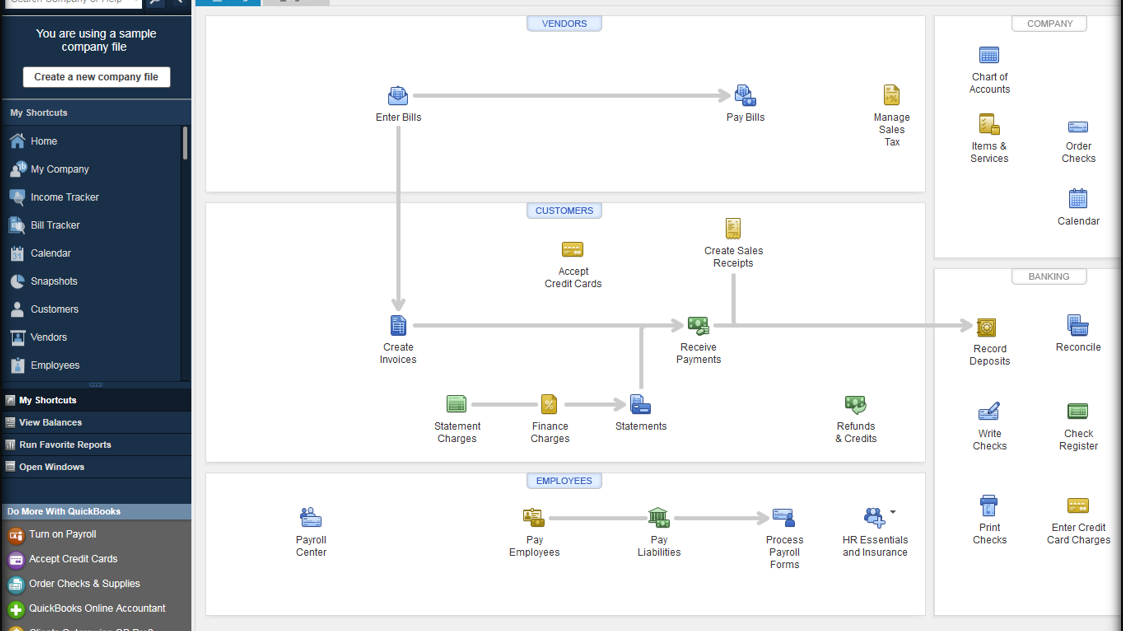

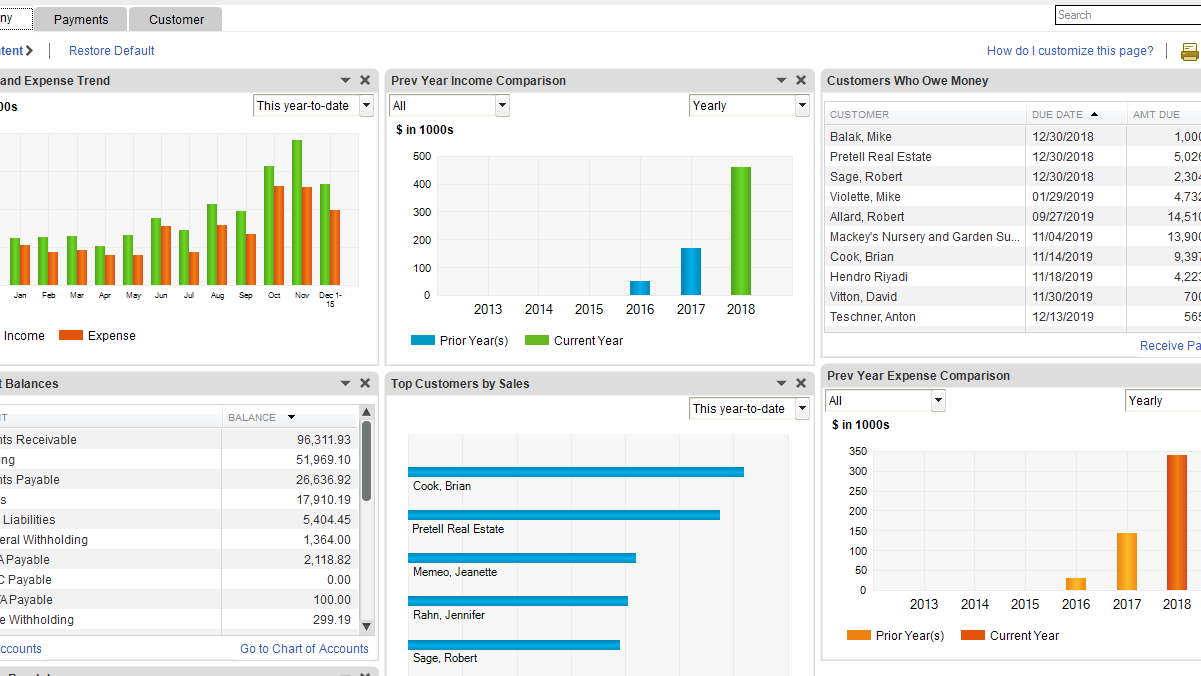

QuickBooks Professional

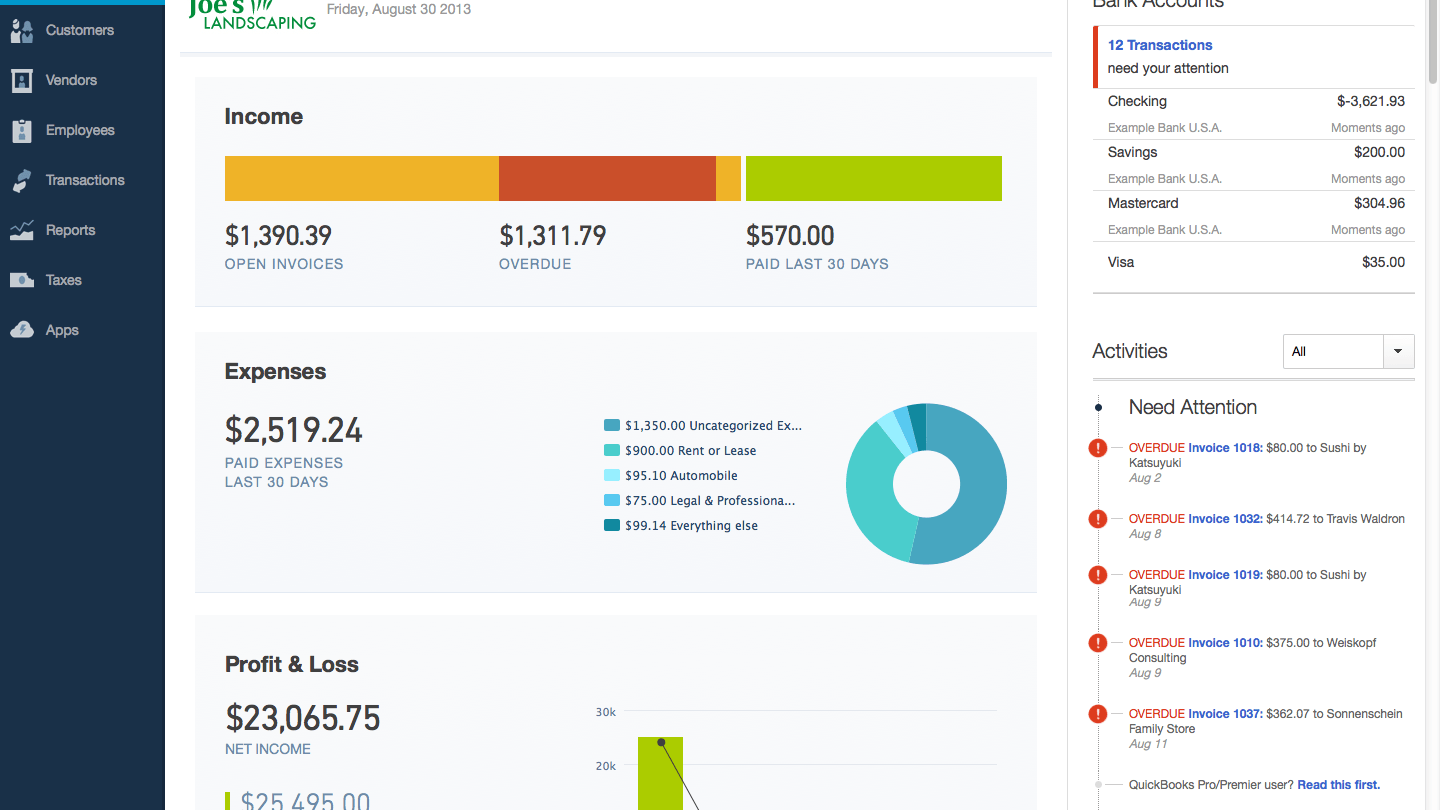

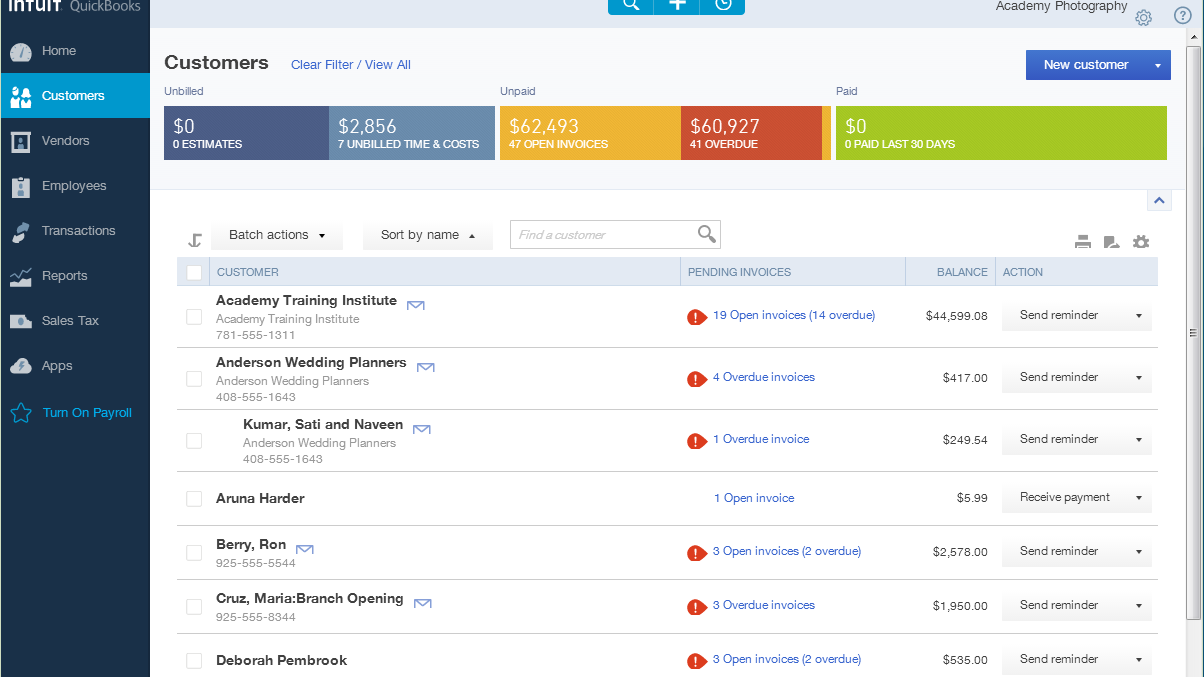

QuickBooks Online

Complete Feature List

QuickBooks does an excellent job of managing the core of business accounting, but lacks certain law-firm-specific features.

Time & Expense Tracking

Track billable hours and related expenses for a particular client or matter. However, time tracking is very limited, and best managed in dedicated Law Practice Management software.

Invoicing

Generation of invoices, including for billable hours, contingency work, and fixed-fee matters.

Chart of Accounts, P&L, Balance Sheet

QuickBooks includes the fundamentals of accounting, including a complete Chart of Accounts, P&L accounts and Balance Sheet accounts.

Bank Accounts and Credit Cards

QuickBooks includes registers for managing bank accounts (operating accounts) as well as for credit cards and lines of credit.

Financial Reporting

QuickBooks includes fundamental reports (Income Statement, Balance Sheet, Cashflow Statement) as well as many other canned reports, as well as the ability to create your own custom reports.

Budgeting

Create a monthly firm budget, and compare each month's actual finances to your budget (Budget vs. Actual).

Client & Vendor Management

QuickBooks includes basic management of Clients and Vendors, including the ability to store contact information and see transactions for any given client or vendor.

Access for Your Accountant

Both QuickBooks Professional and Online provide capabilities to give your accountant access to your books.

Trust Accounting

Trust/IOLTA accounting for management of trust funds, including trust account reporting.

Split Billing

QuickBooks does not include split billing, or the ability to attribute invoices across different attorneys.

Legal Billing Reports

Report billing/revenue by Matter, Client, Originator and other metrics.

Practice Management Integrations

As described, QuickBooks is a strong accounting platform, but lacks certain law firm-specific capabilities, namely around time tracking, legal billing and trust accounting. Fortunately, QuickBooks integrates with many Law Practice Management products. These include:

- LEAP

- Clio

- Time Matters

- Rocket Matter

- MyCase

- Practice Panther

- Bill4Time

- FirmCentral

QuickBooks Pricing

Pricing information provided is made up of intel from customers, consultants, and in some cases the software publisher.

QuickBooks Professional

- Pro Plus: $199.99 / Year

- Pro Plus Payroll: $599.99 / Year

- Enterprise: $1147.50 / Year

Annual pricing for one user shown. For additional information visit the Intuit website.

QuickBooks Online

- Essentials: $20 / User / Month

- Plus: $35 / User / Month

- Advanced: $75 / User / Month

Annual pricing shown. For additional information visit the Intuit website.

QuickBooks in the Cloud

As outlined here, QuickBooks Professional is more developed, and a better fit than QuickBooks Online for most law firms.

Running QuickBooks Professional in secure Private Cloud, via a Virtual Desktop platform, gives your law firm the advantages of the cloud, without having to maintain servers and deal with IT headaches.

Advantages of QuickBooks Professional in the Cloud

The Best of Both Worlds

Keep the robust legal software that your firm is committed to and relies on, while enjoying the advantages of the Cloud.

Work From Anywhere

Unchain your self from the office, ditch clunky VPN and remote-computer-login "solutions." A Private Cloud provides a secure, easy-to-use Virtual Desktop that gives you access to your legal software, documents and email from anywhere.

Data Security & Compliance

Secure Private Cloud platforms, like Uptime Practice, keeps your software and data secure. End-to-end data encryption, Multi-Factor Authentication, Geographic Data Redundancy (Backups), Virus Protection and Ransomware Protection will keep your data secure and your firm compliant.

Eliminate Servers & IT Headaches

Maintaining servers and managing IT is a pain, even with a capable local IT support firm. A Private Cloud like Uptime Practice provides all necessary server infrastructure, managed, backed up and ready-to-go: So you can focus on your firm and your clients.

Minimize Downtime

Capable Private Cloud platforms like Uptime Practice are built with enterprise-grade infrastructures, and managed round-the-clock by professionals. This minimizes downtime for your firm, and maximizes productivity.

Flexible & Scalable

Stay flexible: Cloud-based solutions allow you to scale users, software, storage and options up or down as needed.

Economical

We consistently see Private Cloud solutions deliver a lower Total Cost of Ownership compared to managing on-premise, in-house servers and IT equipment. Study the Financial Case for Private Cloud, or get our Cloud Cost Calculator.

Ready to Get QuickBooks in the Cloud?

At Uptime Legal, we host QuickBooks and other legal software for hundreds of law firms across North America.

Get in touch with our team to learn more about QuickBooks in the cloud for your law firm.

Learn More:

Learn more about running QuickBooks in the Cloud.

Uptime Practice:

The IT & Cloud Platform for Law Firms.

Uptime Practice is a suite of Managed IT and cloud services, made exclusively for law firms.

Practice Next

Technology + Legal Software Support for Modern Law Firms

Practice Next is a suite of Managed IT, Legal Software Support, and Cloud Essentials, made just for law firms.

-

Practice Next is a suite managed IT, technology essentials and legal software support.

-

Practice Next includes unlimited IT and legal software support, Microsoft 365, legal-centric cloud storage and more.

-

Practice Next pairs great with cloud-based legal software such as Clio Manage, CosmoLex, MyCase and more.

Practice Go

Cloudify Your Legal App

Does your law firm already have a cloud strategy, but have one premise-based application still running on onsite servers? Practice Go is for you.

- With Practice Go, we effectively turn your desktop/server- based legal software into a cloud application (a Published App), freeing your firm from the limitations of traditional software.

- Practice Go can cloudify your PCLaw, Time Matters, Tabs3, ProLaw, Juris, QuickBooks and more.

Practice Foundation

Complete Private Cloud for Law Firms

If your law firm needs a central, secure cloud platform for all of your legal software, documents and data, Practice Foundation is for you.

-

Practice Foundation is an end-to-end cloud platform that will host all of your firm's applications and documents, and will optionally include Office 365 + unlimited IT support. Everyone in your firm logs into a Virtual Desktop where they'll find all of their apps and docs.

-

Practice Foundation works with PCLaw, Time Matters, Tabs3, ProLaw, Juris, QuickBooks, Timeslips, TrialWorks, Adobe Acrobat and more.

Not Sure Which Edition You Need?

No problem. Check out our quick Comparison Chart for Uptime Practice, or Get in Touch to talk with our sales team.

Dennis Dimka

As the founder and CEO of Uptime Legal Systems, I've had the privilege of guiding our company to become a leading provider of technology services for law firms.

Our growth, both organic and through strategic acquisitions, has enabled us to offer a diverse range of services, tailored to the evolving needs of the legal industry.

Being recognized as an Ernst & Young Entrepreneur of the Year Finalist and seeing Uptime Legal ranked among the Inc. 5000 list of fastest-growing private companies in America for eight consecutive years are testaments to our team's dedication.

At Uptime Legal, we strive to continuously innovate and adapt in the rapidly evolving legal tech landscape, ensuring that law firms have access to the most advanced and reliable technology solutions.

Related Posts

March 13, 2024

Law Firm Collaboration Software

January 9, 2024

VoIP for Law Firms

January 8, 2024

How to Use Orion Legal Software in the Cloud in 2024

January 8, 2024

How to Use Timeslips & QuickBooks in the Cloud in 2024

December 15, 2023

ProLaw: Complete Review, Features, Pricing

December 15, 2023

Juris: Complete Review, Features, Pricing

December 15, 2023

PCLaw: Complete Review, Features, Pricing

December 15, 2023

7 Reasons Your Law Firm Should Consider Clio Manage

December 15, 2023

LEAP: Complete Review, Features, Pricing

December 15, 2023

Tabs3 & PracticeMaster: Complete Review, Features, Pricing

December 15, 2023

Time Matters: Complete Review, Features, Pricing

November 1, 2023

Clio Review: Details, Features, Pricing

October 24, 2023

AWS for Law Firms: A Complete 101

October 4, 2023

Azure for Law Firms: A Complete 101

December 8, 2021